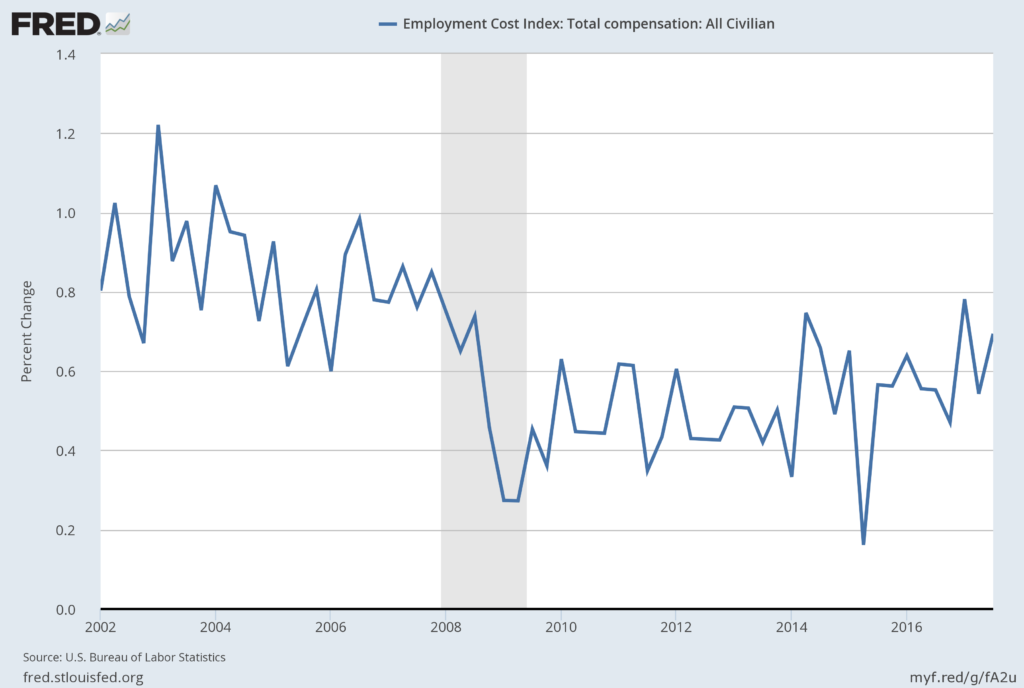

While the concept of Americans’ incomes can be defined in a number of ways, many prominent measures continue to show disconcerting trends.

One prominent measure is the Employment Cost Index (ECI).

The Employment Cost Index (ECI) is a quarterly measure of the change in the price of labor, defined as compensation per employee hour worked. Closely watched by many economists, the ECI is an indicator of cost pressures within companies that could lead to price inflation for finished goods and services. The index measures changes in the cost of compensation not only for wages and salaries, but also for an extensive list of benefits. As a fixed-weight, or Laspeyres, index, the ECI controls for changes occurring over time in the industrial-occupational composition of employment.

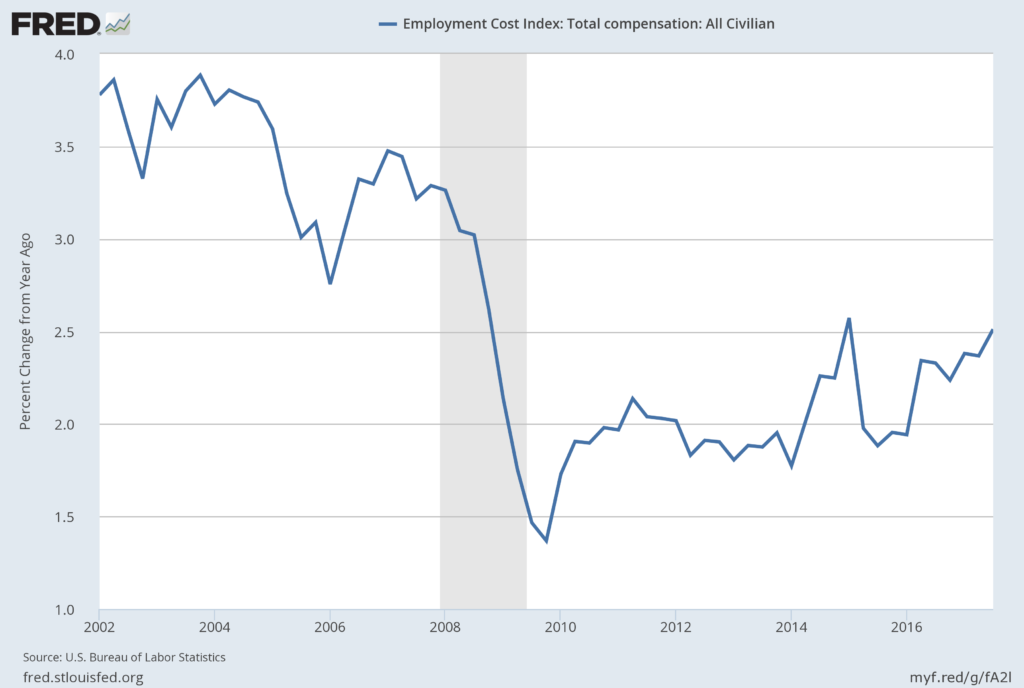

Compensation costs for civilian workers increased 0.7 percent, seasonally adjusted, for the 3-month period ending in September 2017, the U.S. Bureau of Labor Statistics reported today. Wages and salaries (which make up about 70 percent of compensation costs) increased 0.7 percent, and benefits (which make up the remaining 30 percent of compensation) increased 0.8 percent. (See tables A, 1, 2, and 3.)

also:

Compensation costs for civilian workers increased 2.5 percent for the 12-month period ending in September 2017. In September 2016, compensation costs increased 2.3 percent. Wages and salaries increased 2.5 percent for the 12-month period ending in September 2017 and increased 2.4 percent for the 12-month period ending in September 2016. Benefit costs increased 2.4 percent for the 12-month period ending in September 2017. In September 2016, the increase was 2.3 percent. (See tables A, 4, 8, and 12.)

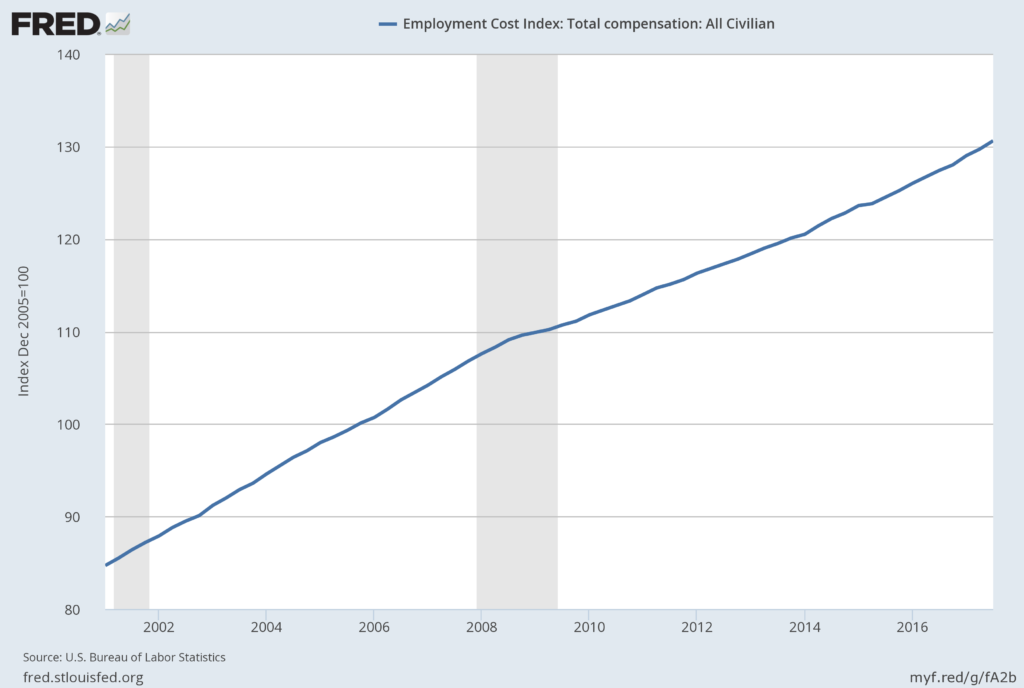

Below are three charts, updated on October 31, 2017 that depict various aspects of the ECI, which is seasonally adjusted (SA):

The first depicts the ECI, with a value of 130.6:

source: US. Bureau of Labor Statistics, Employment Cost Index: Total compensation: All Civilian[ECIALLCIV], retrieved from FRED, Federal Reserve Bank of St. Louis, accessed October 31, 2017:

The second chart depicts the ECI on a “Percent Change from Year Ago” basis, with a value of 2.5%:

The third chart depicts the ECI on a “Percent Change” (from last quarter) basis, with a value of .7%:

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2576.41 as this post is written